When comparing customer acquisition vs retention, the short and sweet answer is that prioritising acquiring new customers is best for growth. However, the long-winded (yet exciting) answer begins with this statement: you absolutely need both to scale up any business. Join us as we explain the significant differences between customer acquisition and retention in this short guide.

If you are unable to keep your clients on board consistently, it may potentially be due to the fact that your business model is unhealthy or effectively not thorough enough to provide your clients with a complete solution. On the other hand, starting a business without clients would be near impossible, which essentially sums up the value of customer acquisition. There’s no denying, however, that being able to both acquire and retain clients is paramount to cultivating a sustainable business.

Acquiring new customers is relatively easy if you offer a high-quality product or service, as well as some sort of branding and evidently have the acquisition capital. Of course, customer acquisition is still easier said than done. Although, in the last 6 years we have been seeing customer cost acquisition increase by 60%, hence why in the long run, it is more sustainable to keep your clients rather than constantly signing on new ones.

To properly answer this question, we’re going under the hood of customer retention vs acquisition; explaining the key differences and how each difference makes one better than the other. Scroll down to read all there is to know about these 2 powerhouse strategies.

What is customer acquisition?

Customer acquisition management is a set of techniques used to manage customer prospects and inquiries generated by your organisation’s digital marketing efforts. Customer acquisition management can be considered to be the connection between advertising and the customer relationship which inevitably goes into the process of acquiring new customers.

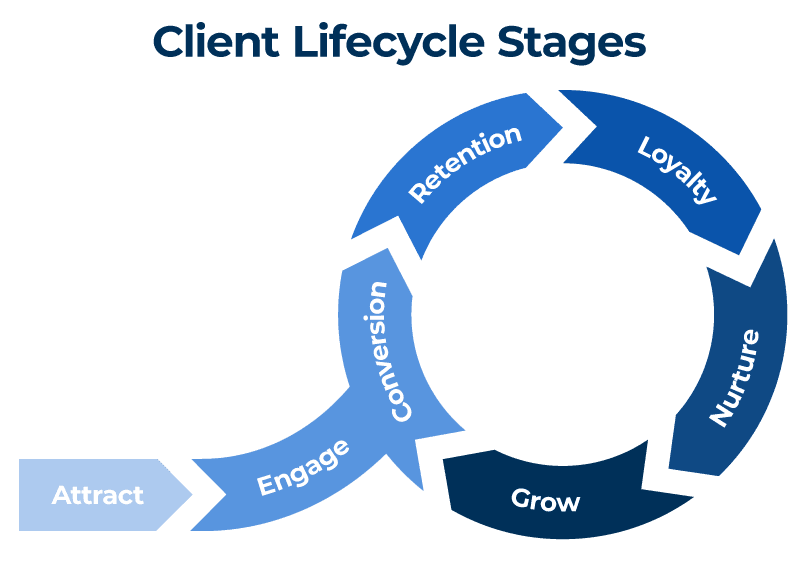

Although customer acquisition does not always start with a marketing investment, when it does, it will likely trigger a pre-purchase process for your new client. This process is the first phase of what we like to call the customer lifecycle. A well-optimised customer lifecycle will likely play a vital role in boosting both your organisation’s customer acquisition or customer retention rates, as satisfied recurrent customers will grow to become advocates for your business and inspire others to seek out your services online.

Refining your organisation’s customer lifecycle generally means finding new ways to offer your customers value and gain an edge over your competitors. You can also ‘hack’ your customer lifecycle (or speed up the process of customer retention/acquisition) by incentivising customers to return or by creating referral offers that will reward both existing and new customers alike.

How is customer acquisition measured?

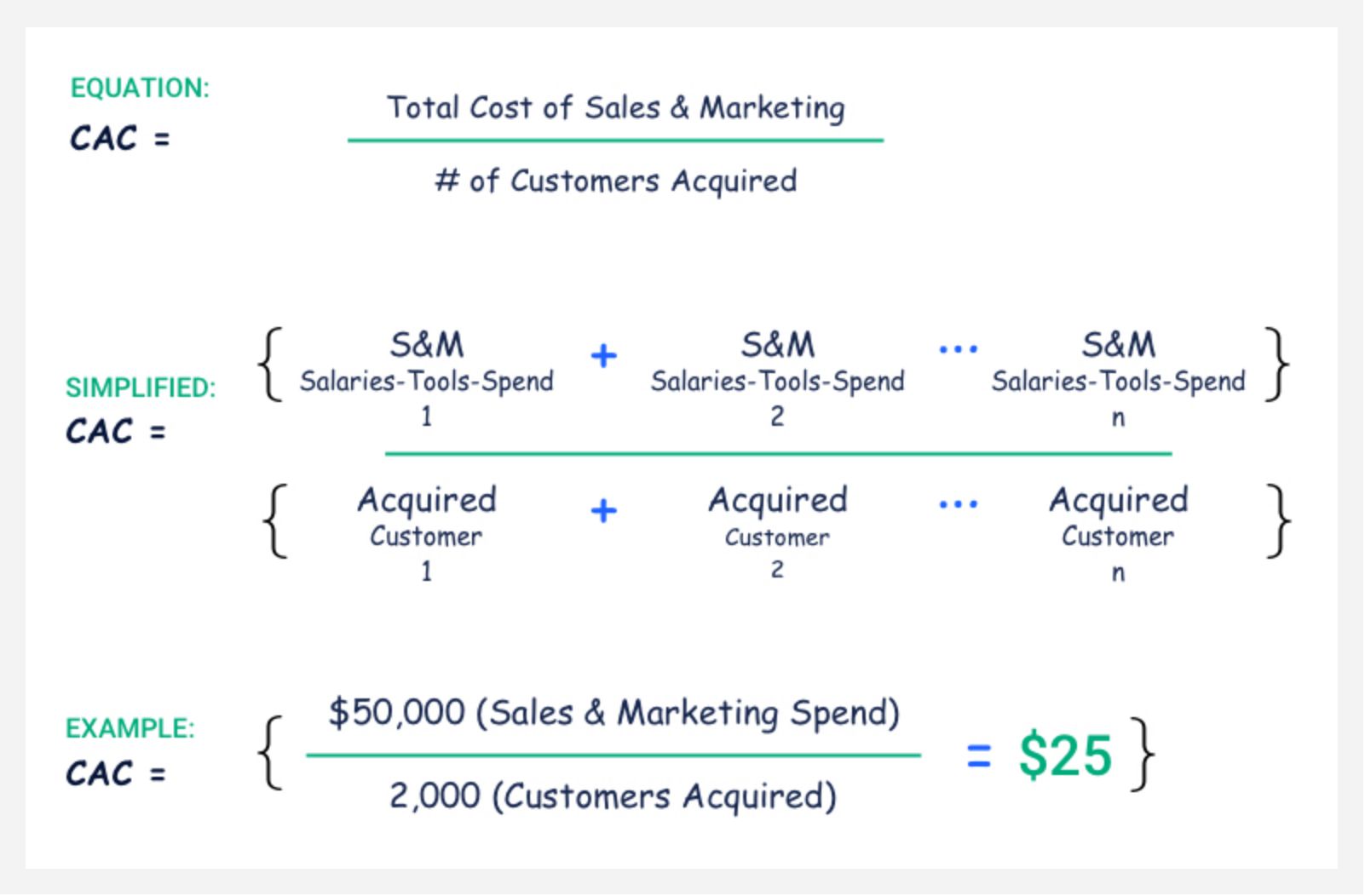

While there are a few metrics that positively and negatively affect customer acquisition, such as the click-through rate of any of your landing pages (CTR) or the conversion rates of your targeted ads, the metric that most business owners are likely to consider above all else would be the customer acquisition cost or CAC as the finite result.

Your CAC is typically calculated by dividing the marketing costs for a particular initiative or time period by the number of new customers that that marketing initiative has generated. Based on your industry as well as the nature of your business model, the conversion could take the form of an order, subscription, purchase, app download, or other form of patronage or engagement with your organisation.

The mathematics for CAC is very simple. For example. if a business spent $100,000 on marketing in a year, and it was able to acquire 10,000 new customers, the CAC would be $10, because $100,000 divided by 10,000 customers equals $10 per customer.

The formula that is used to find CAC looks like this:

Of course, this formula does not take into account total expenditures, such as multiple marketing strategies, staff salaries, and other everyday business expenditures.

In addition, you don’t need to be a seasoned eCommerce specialist to know that conversion is an ongoing endeavour and no campaign comes with guarantees of customer acquisition or customer retention. Acquiring a new customer vs retaining a customer generally consists of multiple stages over a number of digital platforms, and it may actually be some time before your potential customers actually become aware of your brand or engage with your website. This is precisely why you may find that your organisation’s CAC will decrease from campaign to campaign, as brand recognition will lead to a prompt engagement with your web presence.

What is customer retention?

Customer retention refers to a company’s ability to turn customers into repeat buyers and prevent them from switching to a competitor. The goal for many organisations is to keep their customer retention rates as high as possible to ensure that your customer base stays large and – most importantly – satisfied with your services and feeling positive about your brand.

This is where the importance of a high customer retention rate really makes itself known. All seasoned business owners know that retaining customers is about more than just transactions—it’s about relationships. Just as the acquisition is a vital phase of the overall customer lifecycle, customer retention is really what allows that lifestyle to exist and sustain itself. The lifecycle ultimately ends when your retained clients become dissatisfied with your organisation or start to view a competing organisation as a more preferable option. More often than not, losing your customers means losing valuable relationships, which equates to your organisation’s network decreasing in size and thus, reducing the likelihood of customer referrals.

How is customer retention measured?

Unlike customer acquisition, customer retention does not get measured with a $ figure. Customer retention is measured with a few different metrics, some of which include your organisation’s user churn rate, retention churn rate, and revenue churn rate.

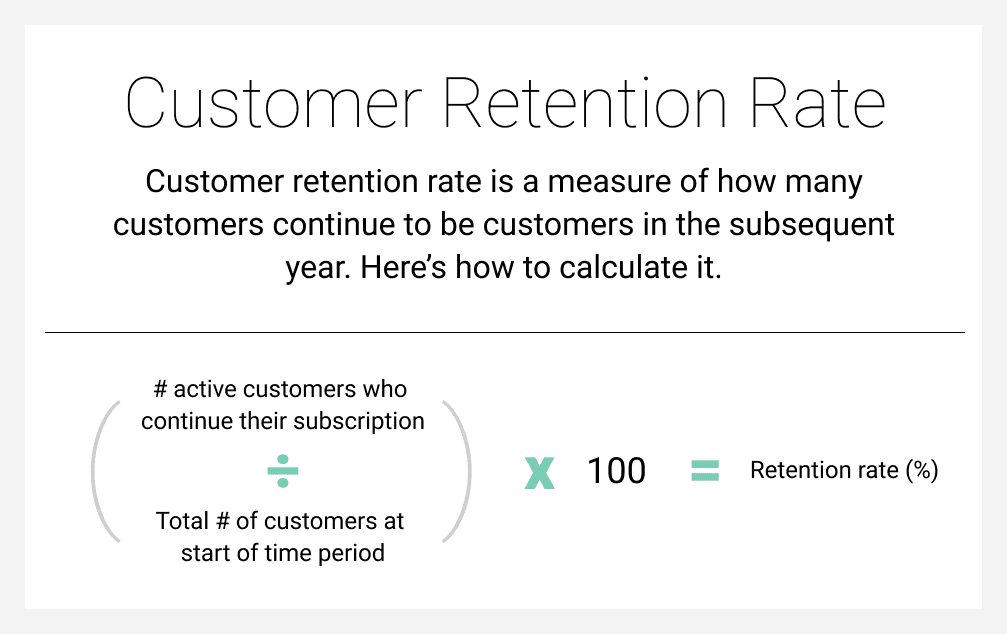

Retention rate is measured by dividing the number of employees that stayed with your company through the entire time period by the number of employees you started with on day one.

The customer retention rate formula looks like this:

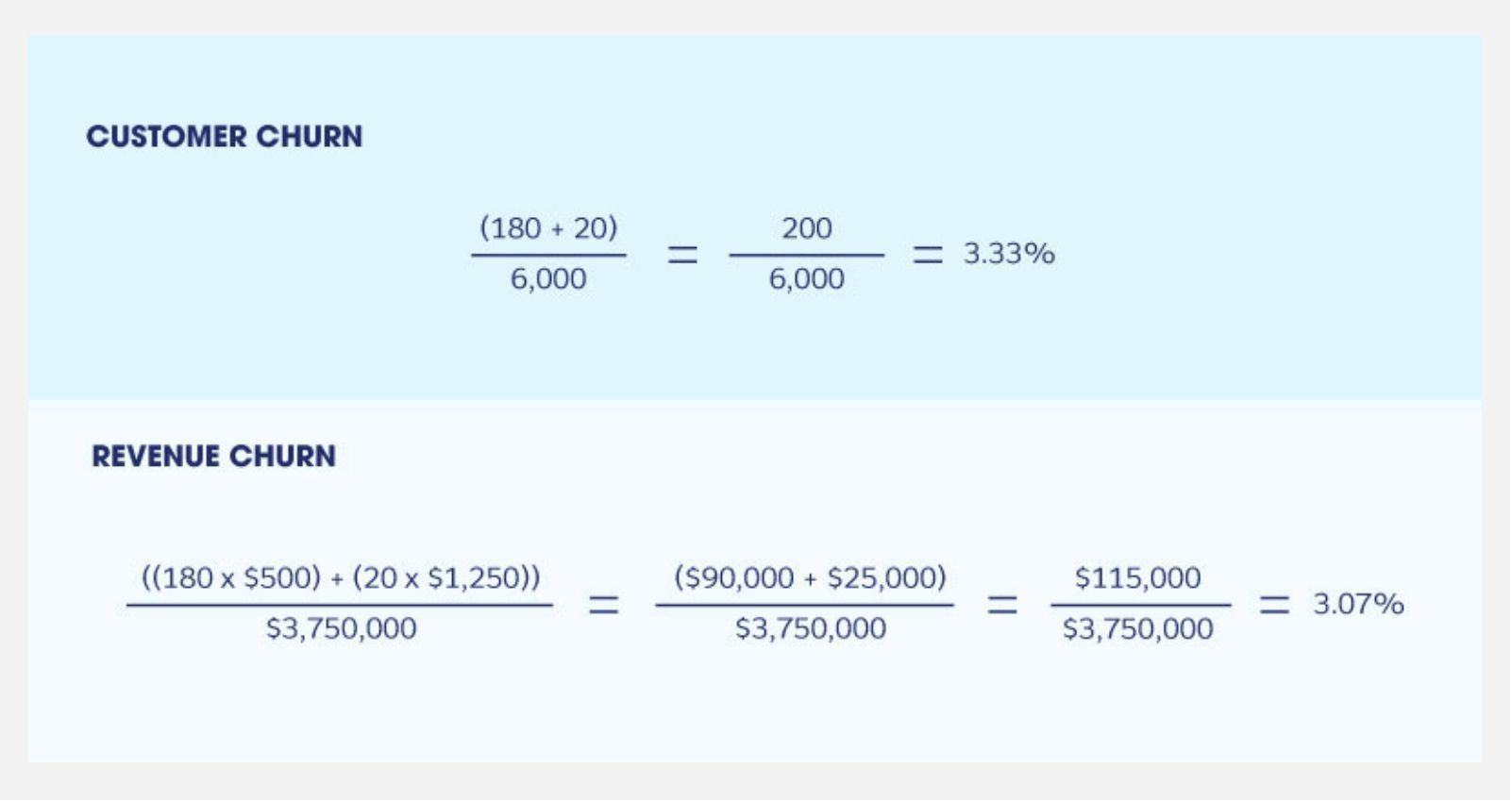

The calculation of churn can be straightforward to start off with. Take the number of customers that you lost last quarter and divide that by the number of customers that you started with last quarter. The resulting percentage is your churn rate.

The customer churn rate formula looks like this:

To determine the percentage of revenue that has churned, take all your monthly recurring revenue (MRR) at the beginning of the month and divide it by the monthly recurring revenue you lost that month — minus any upgrades or additional revenue from existing customers.

The customer revenue churn rate formula looks like this:

Of course, having all these metrics in mind is meaningless if you don’t know how to use them. You can establish KPIs for your digital campaigns to ensure that your marketing investments are delivering the results you need. It’s imperative that you ask yourself what you want to achieve outside of higher profit margins. Is your growth plan to acquire more new customers? Perfect! This is absolutely achievable using a variety of different methods, but the best paths of action will naturally be those that don’t neglect your existing customer base.

Remember that your customer acquisition and retention rates are actually symbiotic, even if they don’t seem to be and even if it doesn’t feel like you can focus on them simultaneously. The fact of the matter is that they feed one another, and the bottom line for any thriving business is to continue cultivating and tending to this positive feedback cycle. Always keep in mind that keeping your customers coming back for more will result in a greater ROI.

Should you focus on customer acquisition vs retention?

There’s no denying that both customer acquisition and retention are equally important. So, the decision surrounding whether your company’s main focus should be on growing customer acquisition vs retention will largely be dependent on your business model and which business development stage your wider enterprise may find itself in at that point in time. If you are only starting a new business, then customer acquisition would naturally be a priority.

If your company has been operating for a while and has garnered itself a decent amount of clients then you should definitely be focusing on customer retention to keep that momentum going. Acquiring new clients is vital but keeping your clients is crucial to the growth of your business. If you don’t invest in retention strategies you will most likely lose a lot of customer satisfaction and loyalty, which will result in losing business in the long term.

On top of all of this, it’s essential to note that depending on your business model, acquiring new clients usually costs about five to ten times more than retaining your existing ones. Some SaaS companies rely on subscription fees and other forms of returning business as their principal source of revenue. In fact, your long term clients will spend more than your new clients, so you can yield a higher ROI on your marketing budget if you build some strong engagement and retention strategies to keep your existing clients happy. While acquisition is important for long-term growth, the costs associated with acquisition are initially much higher if you don’t have a big budget.

~

Depending on the nature of your business, there is a myriad of different strategies that you can use to simultaneously boost your organisation’s customer retention and acquisition rates. If you did have any questions about digital marketing strategies or campaigns that you’d like to bring to life, then our SEO and PPC professionals at Digital Next may have the insights you’ll need to bolster your campaign and boost your acquisition and retention rates along the way too.

Leave A Comment